Introduction

The tax system in the United States can appear to be very complicated, especially when attempting to understand the annual tax tables that change. It is essential for contributors to understand how taxes are calculated relative to their income in order to avoid unpleasant surprises and to maximise their financial situation. En nuestro blog, examinaremos la tabla de taxes en estados unidos 2021, abordando todos los aspectos pertinentes para facilitar a los lectores el navegación confianza en el sistema fiscal.

¿Qué es una Tabla de Taxes?

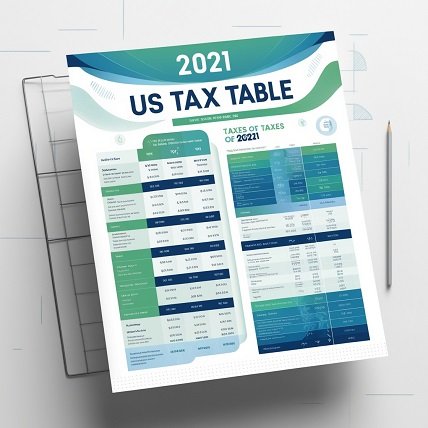

The Servicio de Impuestos Internos (IRS) publishes an annual tabla de taxes en estados unidos 2021, also known as an impuestos table, as a tool to help taxpayers figure out how much they must pay in federal taxes. These tables show the applicable tax rates for various income and state levels, making it easier to calculate the actual amount due.

Estructura de las Tablas de Impuestos Federales para 2021

Las tablas de impuestos se establecen en función de los ingresos imponibles y el status civil del contribuyente para el año fiscal 2021. There are several categories: single, married and presenting jointly, married and presenting separately, and head of the family. Según el nivel de ingresos y el estado civil, cada una de estas categorías posee tramos impositivos diferentes que señalan cómo varía la carga fiscal.

Tramos de Impuestos para Solteros en 2021

The IRS established a series of progressive tax tramos for single taxpayers in 2021. These tramos start at 10% for the lowest incomes and go to 37% for the highest incomes. The imposition brackets are distributed as follows: the first $9,950 is taxed at 10%, while income over this amount up to $40,525 is taxed at 12%.

Tramos de Impuestos para Casados Presentando Conjuntamente en 2021

El IRS ofrece tramos impositivos que trepan los umbrales de ingresos comparados con los solteros para los contribuyentes casados que presentan su declaración de impuestos conjuntamente in 2021. The lower threshold applies to income up to $19,900 at 10%, while income between $19,901 and $81,050 is taxed at 12%. Para ingresos más de $628,300, los tramos progresivos continuan elevando la tasa de impuesto hasta un 37%.

Tramos de Impuestos para Casados Presentando por Separado en 2021

When married contributors choose to submit their taxes separately, they face applicable tax tramps that are comparable to those for single people but with an adjusted threshold. The first $9,950 in income is taxed at 10% in 2021, and every further income over this amount up to $40,525 is taxed at 12%. Para ingresos más de $314,150, los tramos seguirían incrementando hasta un 37%.

Tramos de Impuestos para Jefe de Familia en 2021

The head of family status in tabla de taxes en estados unidos 2021 offers mandatory benefits that are advantageous when compared to singles and married couples who present separately. The family chief tax bracket starts at 10% of income up to $14,200. Thereafter, progressive rates are applied, increasing to 37% of income over $523,600.

Impacto de las Deducciones Estándar en 2021

The standard deductions play a significant role in determining the contributor’s base imponible by lowering the amount of income subject to taxes. The standard deductions in tabla de taxes en estados unidos 2021 were $12,550 for single people, $25,100 for couples presenting jointly, $12,550 for couples presenting separately, and $18,800 for family heads.

Conclusion

To effectively manage your taxes and plan your finances, it is essential to understand the US tabla de taxes en estados unidos 2021. Knowing the tax credits, deductions, and levies will help you make informed decisions that will improve your financial situation. Even while the system may seem complicated at first, a thorough review and, if necessary, professional consultation may help you navigate it successfully.

FAQ

¿Qué hago si no entiendo mi tabla de impuestos?

If you are having trouble understanding the tax table, you might want to use tax preparation software or speak with a tax professional. These resources might offer detailed explanations and help you finish your declaration accurately. Read about more: nanou turf

¿Cómo afectan los cambios en mis ingresos a mi factura de impuestos?

Changes in your income may put you in a different tax bracket and change the total amount you must pay. To determine how taxes are applied to your total income, use the tabla de taxes en estados unidos 2021.

¿Las deducciones estándar cambian cada año?

Yes, the standard deductions usually adjust themselves annually to account for inflation. Examine the updates annually to ensure that you are using the appropriate amount.