Introduction

It can be difficult to navigate the tax system, particularly when attempting to understand porcentaje de taxes, or tax percentage. It’s essential for both individual and business owners to comprehend how tax percentages operate in order to make informed financial decisions and ensure compliance. We’ll go over the subtleties of tax percentages, their effects, and useful management advice in this extensive tutorial. You’ll have a better knowledge of how taxes are determined and how they affect your finances at the end.

“Porcentaje de Taxes”: what is it?

The phrase porcentaje de taxes refers to the portion of revenue or profit that has to be given to the government as taxes. Depending on the type of tax and the jurisdiction where it is imposed, this proportion can vary significantly. There are many different kinds of taxes, each with their own percentage rates and legal requirements. These include income taxes, corporation taxes, sales taxes, property taxes, and capital gains taxes.

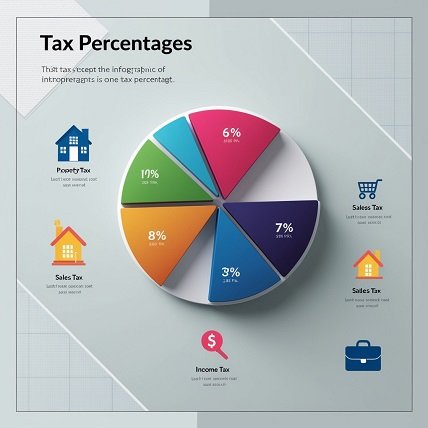

Different Tax Types and Their Shares

There are a few general categories into which taxes fall, and each has a different percentage rate. One of the main forms of taxes is income tax, which is paid by corporations or people to the government as a percentage of their earnings. This percentage might be flat, where all income is taxed at the same rate, or progressive, where higher earnings are taxed at increasing rates. The corporate tax that is levied on business profits is contingent upon the location and size of the company. At the moment of sale, sales tax is a percentage that is added to the cost of products and services.

How One Calculates Tax Percentages

Government laws, income brackets, and jurisdictional variations are some of the reasons that affect porcentaje de taxes. Legislation, which is subject to change in reaction to policy changes or changes in the economy, is how government bodies determine tax rates. greater income levels are subject to greater tax rates, and the percentages for income taxes frequently change with income bracket. Another important factor is jurisdiction; various nations, states, or provinces have their own tax laws and regulations.

Tax Systems: Progressive vs. Regressive

Tax systems can be categorised as proportionate, regressive, or progressive; each has a distinct impact on taxpayers. Higher tax rates are applied to higher income bands under a progressive tax system, which means that as income rises, so does the proportion of income that is taxed. On the other hand, a regressive tax system burdens people with lower incomes more since some taxes, such as sales taxes, take a bigger share of their income from people with lower incomes.

How to Determine Your Tax Percentage

Your tax percentage must be calculated in multiple phases. Start by figuring out your taxable income, which is the total of all of your income sources less any exemptions or deductions. Next, determine which tax rates and brackets apply to your income level. To get your overall tax obligation, apply these rates to your income in each tax bracket. Lastly, to determine your effective porcentaje de taxes, divide your whole tax due by your taxable income and multiply the result by 100.

Tax Credits and Deductions

The total amount of taxes due is largely determined by tax credits and deductions. Your taxable income is decreased via deductions, which may result in a less tax liability. Expenses for student loans, medical bills, and mortgage interest are examples of common deductions. On the other hand, tax credits immediately and dollar-for-dollar lower the total amount of porcentaje de taxes. Tax credits for home upgrades that save energy or for educational costs are two examples of this.

Tax Percentages’ Effect on Financial Planning

porcentaje de taxes have a big impact on how finances are managed and planned. Having a realistic budget and efficient expense management are made easier with knowledge of your effective tax rate. Investor decisions and tactics may be influenced by their knowledge of the tax implications of certain investments. Additionally, long-term financial planning may be impacted by tax consequences on retirement savings and withdrawals.

Conclusion

Knowing porcentaje de taxes is crucial for both individual and business owners to handle their finances effectively. Understanding the various tax forms, percentage calculations, and how they affect your finances will help you plan ahead and make wise decisions. To effectively negotiate the intricacies of the tax system, keep yourself informed on changes to tax regulations and seek professional advice as necessary. Read about more: mad telugu movie review

FAQ

What distinguishes the effective tax rate from the tax percentage?

The effective tax rate is the average rate you actually pay on your income after deducting credits and deductions. The tax percentage is the rate applied to income or profits.

How frequently are tax percentages adjusted?

Tax percentages are subject to annual adjustments or changes in response to new laws. It’s critical to keep up with the most recent laws and prices.

Can I use deductions to lower my tax percentage?

Deductions do, in fact, lessen your taxable income, which in turn may cut your overall tax burden and possibly even your effective tax rate.